prince william county real estate tax payments

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date.

. If your real estate account does not show on the My Accounts screen it is because real estate account types generally do not automatically link when registering. Please contact us at. Enter the Account Number listed on the billing statement.

Prince William County Taxpayer Services PO Box 2467 Woodbridge VA 22195-2467. This tax is based on property value and is billed on the first-half and second-half tax bills. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county.

Residents can pay their tax by check in the mail online using eCheck via phone using a credit card. The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct. You can pay a bill without logging in using this screen.

The real estate tax is paid in two annual installments as shown on the tax calendar. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. What is different for each county and state is the property tax rate.

In Prince William County Virginia the tax rate is 105 which is. The system will verbally provide you with a receipt number for you to write down. Payments sent by express or overnight mail package delivery and mail that require a receipt signature should be sent to.

This estimation determines how much youll pay. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday.

These buyers bid for an interest rate on the taxes owed and the right. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program. Press 2 to pay Real Estate Tax.

If you are sending a payment and not using the remittance document and envelope please send your payment to. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Prince William County VA currently has 437 tax liens available as of April 2.

-- Select Tax Type -- Bank Franchise Business License Business. By creating an account you will have access to balance and account information notifications etc. Press 1 to pay Personal Property Tax.

Report changes for individual accounts. The County also levies a supplemental real estate tax on newly-constructed improvements completed after the. However we can assist you in linking your real estate account.

When are property taxes due in Virginia County Prince William. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Prince William County VA at tax lien auctions or online distressed asset sales. Click here to register for an account or here to login if you already have an account.

In an effort to mitigate the impact of rising residential real estate assessments the proposed budget is funded at a reduced real estate tax. The first monthly installment is due July 15th. Enter your payment card information.

By phone at 1-888-272-9829 jurisdiction code 1036. CuraDebt is an organization that deals with debt relief in Hollywood Florida. You will need to create an account or login.

Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure. Prince William County Property Tax Payments Annual Prince William County. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

About the Company Prince William County Property Tax Relief For Seniors. It was founded in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. There are several convenient ways property owners may make payments.

Prince William County accepts advance payments from individuals and businesses. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct.

The property tax calculation in Prince William County is generally based on market value. Find Prince William County residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Provided by Prince William County.

Ad Submit Your County of Prince William Payment Online with doxo. Report a New Vehicle. Report a Change of Address.

Dial 1-888-2PAY TAX 1-888-272-9829. By mail to PO BOX 1600 Merrifield VA 22116. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return.

Report a Vehicle SoldMovedDisposed. Personal property taxes for Prince William County residents are due on or before Oct. The second and all subsequent installments are due on the 5th of each month with the final payment being due on June 5th.

Prince William County - Home Page. Based on these rates the average.

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Now Accepting Applications Restore Retail Grant Program

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

5572 Saint Charles Dr Woodbridge Va 22192 Dale City Saint Charles Keller Williams Realty

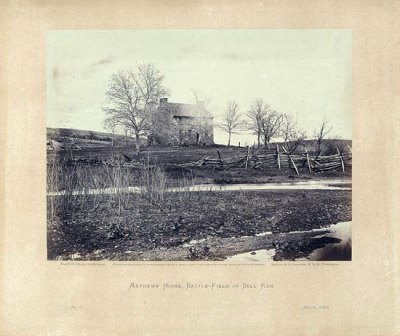

The Rural Area In Prince William County

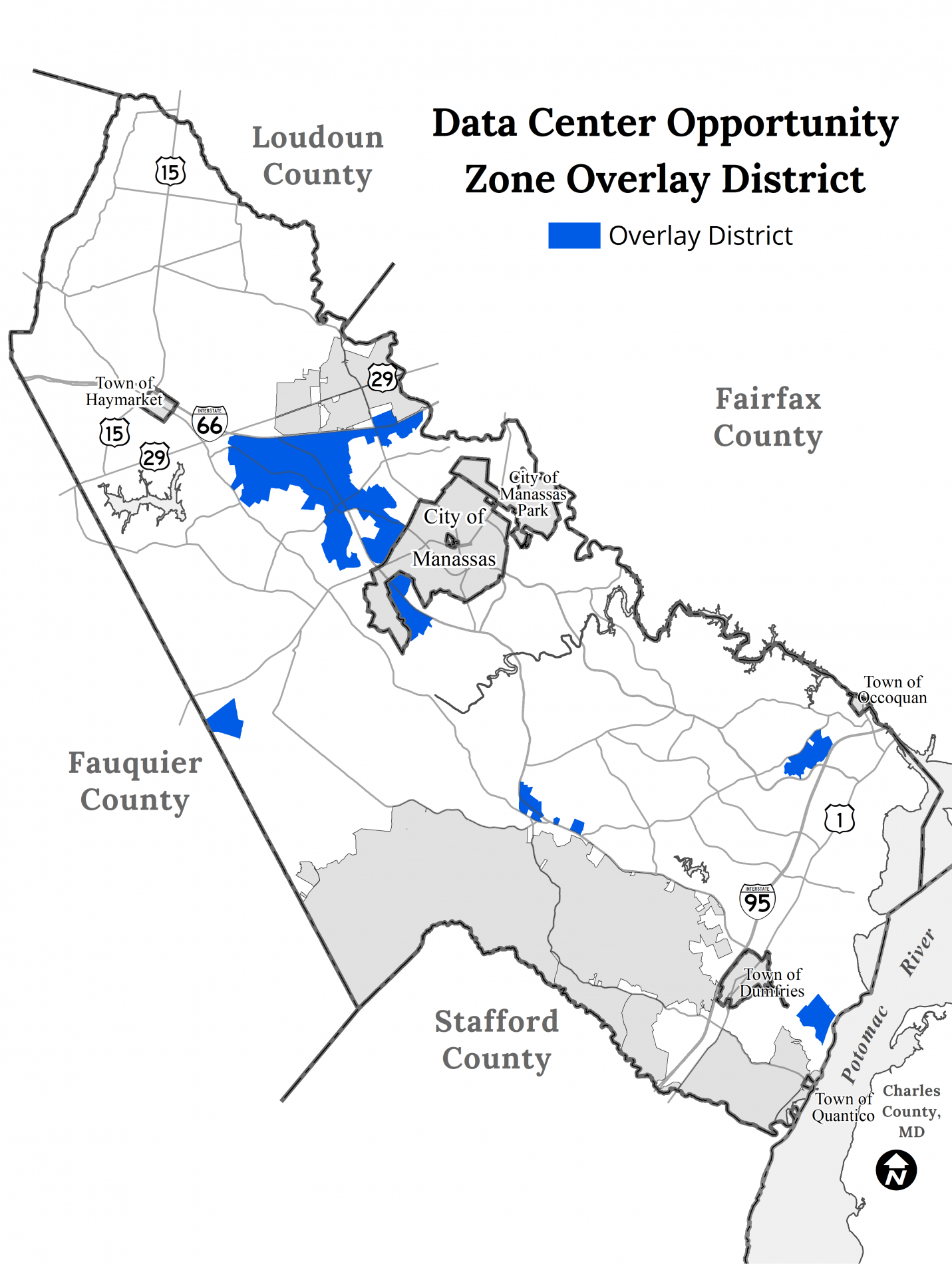

Data Center Opportunity Zone Overlay District Comprehensive Review

Check Out Our Private Real Estate Mastermind For Top Realtors Join 19 000 Of Your Re Friend Lead Generation Real Estate Real Estate Leads Home Buying Process

Prince William County Housing First Time Homebuyer Program Youtube

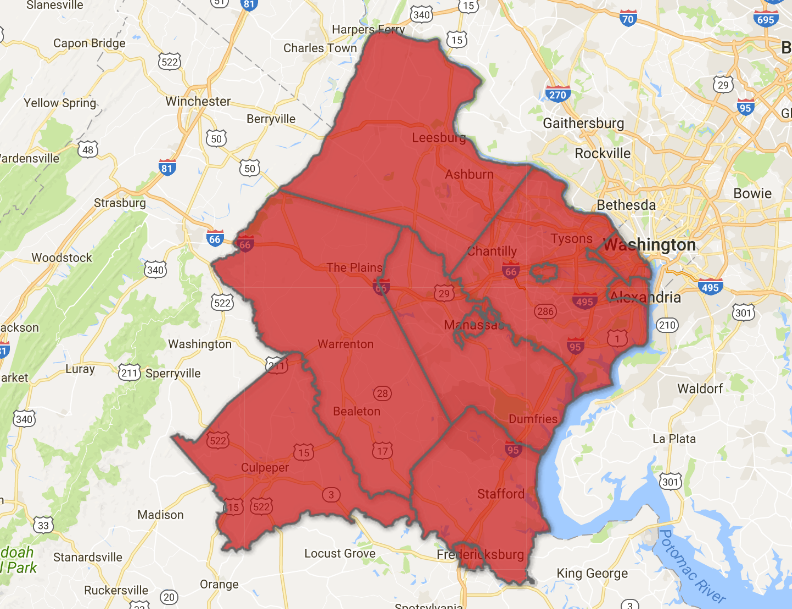

Where Residents Pay More In Taxes In Northern Va Wtop News

The Rural Area In Prince William County

Guest Column When Is Manassas Not Manassas Opinion Princewilliamtimes Com

National Park Service Prince William Forest Park Sign Virginia Travel Forest Park National Park Service

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living